An investment in your business

Financial wellbeing can lead to more engaged employees and consequently higher levels of performance, transforming your organisation into an employer of choice. It’s also a great way to:

- Raise staff morale

- Improve performance

- Improve retention levels

An investment in your people

The benefits can include improving their money management skills, enabling them to make more informed decisions around their finances whilst giving them access to better value products.

- Improve money management

- Reduce financial anxiety

- Reduce stress

Our approach to financial wellbeing

Financial wellbeing affects everyone, from all different professional backgrounds and pay grades. Whether you’re earning £200k a year or £20k a year, financial wellbeing is directly linked to your individual borrowing, saving and spending habits and not your earnings. We’ll design a strategy that is fully inclusive of everyone in your organisation at a level that is easy to understand.

Designing your strategy

To support your organisation develop, deliver and embed a financial wellbeing programme into your workplace, our team of experts have developed a strategy centered around 3 pillars; strategy, education and outcomes.

With this approach, we’ll help your employees manage their short and long term finances, with the aim of helping them make better financial decisions.

1. Strategy

We understand that as an organisation, you’re unique and so are your people. The financial issues and needs of your people vary according to a number of factors, such as; their demographic, type of work, remuneration levels and location.

We’ll help build a framework for your employees to access the appropriate level of help, as and when they need it.

2. Education

The foundation of our approach centres around two core modules that provide a foundation to drive change. We then develop a range of sessions using topics from our optional modules below to address specific stress points.

We then use a range of delivery techniques to ensure everyone in you organisation can get engaged with your financial wellbeing programme, as and when they need it.

3. Outcomes

Where possible, our strategy will be designed with your employee benefits programme in mind to provide a solution specific to a financial stress point. With a trusted solution, it will make it more likely your people will act to improve their financial wellbeing.

Should we highlight any areas where your employee benefits programme doesn’t offer a tangible solution or product, we’re able to review and propose a number of provider solutions that you may wish to consider.

Delivering financial guidance

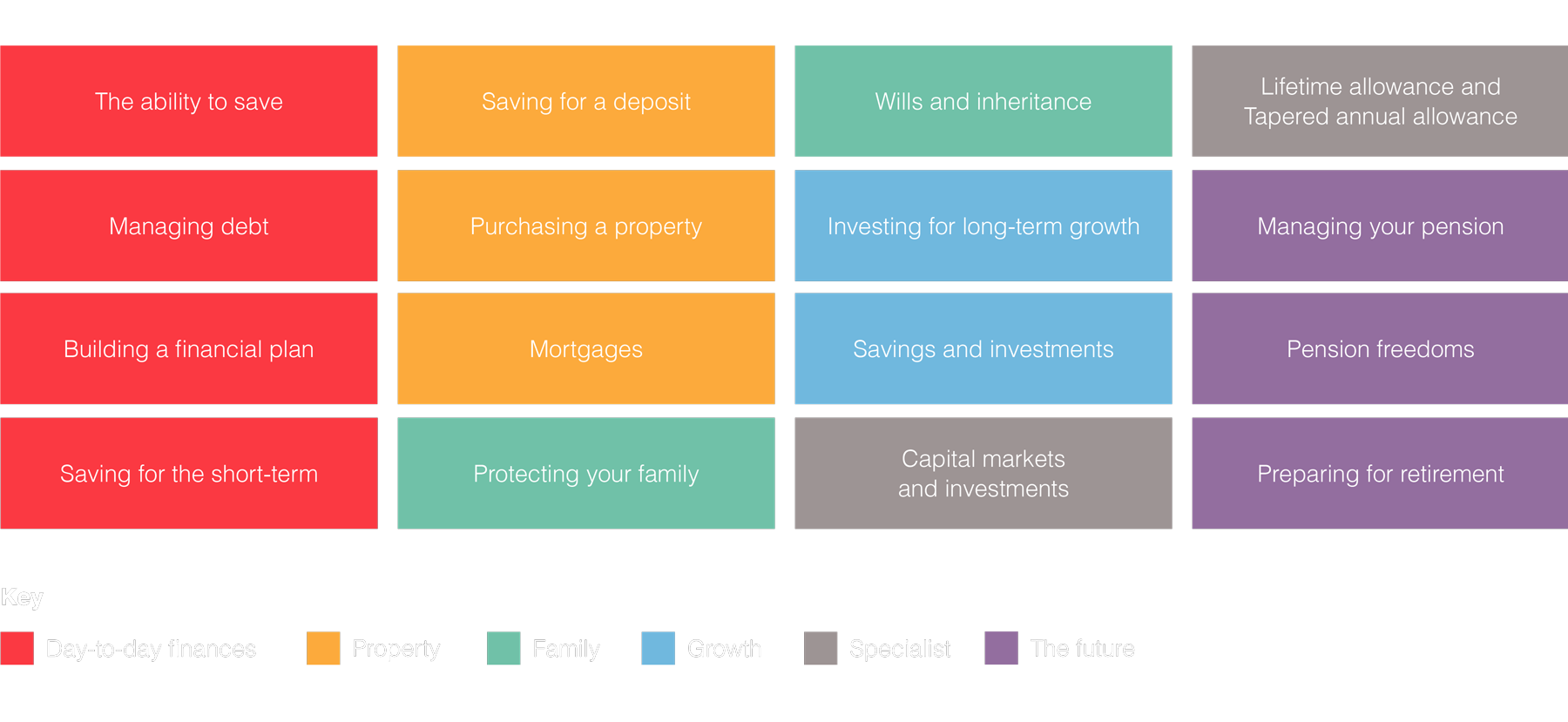

Financial wellbeing is a complex matter and covers a wide range of topics. We’ll use a careful blend of the modules below to design and deliver educational sessions bespoke to the needs of the audience and designed with your company brand in mind. Delivered on-site or via interactive technology, these sessions are designed to help raise your people’s financial knowledge and help them make more informed financial decisions.

Providing access to advice

Personal finance can sometimes be complicated. By giving your people access to guidance and advice in the workplace you can help can make their life easier, immediately improve financial wellness and let your employees spend more time on the things that are most important to them.

Financial advice

Our regulated advisers are here to help your people manage their personal finances, helping with everything from advice around tax allowances so people don’t pay more tax than they have to, or help making sure their investment portfolios are aligned to their personal goals and in line with their attitude to risk.

- Annual tax allowance planning

- Planning for higher earners

- Pre and at retirement planning

- Risk graded portfolio construction and management

- Lifelong ‘cashflow modelling’ to answer the big financial questions and create a financial ‘masterplan’

Mortgage guidance and advice

Our mortgage guidance sessions are a great employee benefit to offer your workforce and give your people the opportunity to receive guidance around mortgages whether that be buying their first property, remortgaging or buying an investment property.

After each session, we will follow up with all of the attendees and answer any questions specific to their personal circumstances. Should an employee decide that they would like to go ahead with applying for a mortgage, we can do that on their behalf should they want us to and we will take the process through to completion.

- First time mortgages

- Remortgaging

- Buy to let mortgages